Today a guy came in to purchase some incense. When he got to the checkout, he handed me a card that looked like it was printed out maybe in 1970 and carried in his wallet for the intervening 43 years and expected me to know what to do with it. Allegedly, it was a Disabled Veteran’s Tax Exemption card.

I have never seen one of these before. There is no photo on the card, only a name. It’s not even laminated, just like an old social security card. Anyone can print out something like that, so for all of these reasons I’m like, dude, I have no idea what that is.

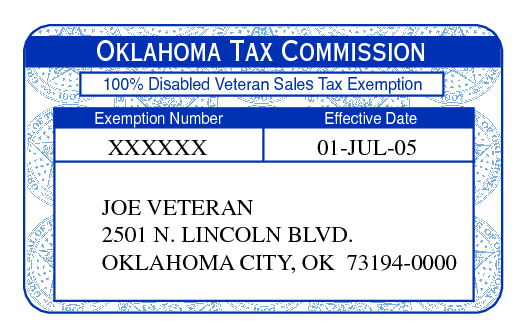

As you can see, this looks just a little sketchy.

I’ve held a sales tax permit since 2000 and have never, ever been informed of this stuff. There’s not a place on the sales tax forms I have to fill out every month to account for sales to people with these disabled vets cards. So for all I know, it’s something this guy made up to get out of paying sales tax.

My cash register does not have a manual over-ride for the tax status. I would have to manually reprogram each and every PLU in order to ring him up properly – even if I knew how to do that without digging out my instruction book, I would not do that for one person. I don’t have enough PLUs to make a set of duplicates, and I am not going to buy a second cash register so I can program it just for tax exempt people. Maybe if we have a whole lot of ’em coming in it would be worth it, but it took me literally DAYS to get this one programmed for the ones we use now, so yeah. Forget it.

But the guy was screaming and hollering (not literally) about how he was going to call the Tax Commission on me if I charged him tax and that it was going to cost me a $500 fine. I have just looked this up, and he was wrong – since this was coming out of the blue, and I had no idea what the hell he was talking about, in fact I would not have been eligible for the fine.

I reminded him that as an independent retailer, I have the right to refuse service to anyone for any reason. I own all the stuff in the store outright unless it is on consignment, and you cannot force me to sell it to you if I don’t want to.

Normally, of course, we do want to sell ALL our stuff to EVERYONE.

However… I also am the sole person responsible for 100% of my data entry, so if I am going to have to fuss with keeping track of 80 cents of sales tax that didn’t happen, you can bet that it’s going to take more of my time than it’s worth to me to sell you ten bucks worth of incense. I’d rather not have that bookkeeping mess to deal with. Coz you know, even if I don’t have to report it to the state, I still have to keep track of it for the IRS, both the income and the inventory ends of it. IT’S A LOT OF TROUBLE.

After they left (without incense – I recommended Amazon to him for his tax-exempt needs), I rang up the Oklahoma Tax Commission and bit off some ears about how this is just another bookkeeping headache they’re imposing on small businesses. There’s not even a place on their website where you can type in the number to verify that it’s not hokum.

There’s not even a picture of what the card is supposed to look like online ANYWHERE. Edit: while looking up something else, I came across an OTC publication that actually shows what the Disabled Vet’s Tax Exempt Card looks like. There is no photo ID on the card itself, which to me is pretty suspicious. The OTC woman said they’re supposed to show a photo ID as well, which the guy didn’t bother to provide when he was getting all huffy about how I’d just better honor it or he’d report me. (I’m like, dude, report it if you want, but also make sure that you tell them this is the first I’ve ever heard about it, and it would be nice for them to let their permit holders know about these things in the “Business Education Packet” that comes with the tax permit forms.)

The guy claimed that he would not be eligible for a refund of his sales tax. Just so readers know, here is the link to the sales tax refund form in case some asshole like me refuses to honor their sketchy looking card. Also, tax exempt purchases are limited to $25,000 per year (sales amount, not tax amount), so for all I know, someone’s met or exceeded that dollar amount and they should be paying sales tax on their stuff anyway. Here’s the form you can fill out if some shopkeeper denies your exemption card – have at it, man, if the people wanting us to be excrutiatingly exact in our bookkeeping and pay every last penny of required sales tax don’t want to tell us about when we don’t have to report it, fine. I am not going to hang out on the OTC forums just in case some other weird law gets passed exempting people with, say, anarchy tattoos. Report me, and we will see if the tax people even have time to track down your fifty cent claim.

I am one guy wearing a ton of hats and that includes a very worn and tattered green eyeshade for my accountant role. If you ask me to have to fill out special paperwork for you just so you can buy incense, I will encourage you to go elsewhere. Honestly, I just don’t have time for that. I am not trying to be unfriendly but I have to draw a line someplace and that someplace is that, months from now when I am doing my data entry for that particular sale, I am going to have to figure out how to change up my handwritten relational database to accept your sale as something that will not stick out as a suspicious transaction in the event of an IRS audit.

The guy said, “oh, you can just ring it up, but then do a discount for the amount of sales tax.” Again, not a storekeeper, so how would they know that at the end of the day, the register’s going to report a certain amount of sales tax on a certain amount of purchases, and then this added line item of a mysterious 8% discount. (It would not do 8.375% as a valid discount amount, so he’s going to be paying some tax anyway.) So now that’s TWO things to try to figure out, keep track of, whatever. NO. I refuse to deal with that.

Edit: I got up several hours early on Sunday morning (this post was written last Wednesday) and did some further research. There are over 50 different kinds of sales tax exemptions out there, everything from the one mentioned above to schools to churches to movie companies currently filming in the state. The following policy will apply to anyone across the board – the bottleneck is in my cash register, and that isn’t going to change in the foreseeable future.

So here’s our official policy on any kind of non-wholesale tax exempt purchases. (I do sell wholesale from time to time, but never out of my retail location, and those sales are always invoiced and accounted for separately.)

1. Due to the extreme ease of forgery, we will only process tax-exempt sales when we can phone in to the OTC to verify that your permit is in fact legitimate. There is no automated way to check on this; we have to speak to a human. So that means that your purchases need to take place on a weekday before 4pm.

2. Because we can’t run this through the cash register, all tax-exempt sales must be paid in CASH. Absolutely no exceptions. There’s a 7-11 next door where you can use the ATM. Please try to have as close to exact change as possible because you are going to throw off my register drawer if I have to make change. Please be prepared; it would be discourteous to have us go through all this stuff and then not have change. We can make change for up to five dollars, but if your total is, say, $28.32, do not hand me two $20 bills. Bring small bills. Your money is going straight into my pocket, not into the till.

3. Since we are not going to be able to keep an itemized list of your purchases with our ancient cash register, we are limiting the things that we will exempt. Some things are kept under tighter inventory control than others, so we are flat-out refusing to sell you certain items (everything else can either be written off our inventory as shrinkage, damage, or just plain slush). This is not denying your right to tax-exempt sales, this is exercising our right to deny you service. The things we cannot sell you as exempt without really fucking up our inventory control system and resulting in, again, heaps of paperwork for your relatively small purchase, are as follows: consignment items (all of those MUST go through the register), books, divination tools such as tarot decks or runes, and jewelry over $50. These things all have stock numbers and are individually tracked and cannot just disappear under the table, which is basically how we are going to treat your tax-exempt sale.

4. NO REFUNDS. Since your purchase didn’t happen, you can’t get your money back if you are unsatisfied.

We are not Walmart. We are not Home Depot. We are not Amazon. I do not have a staff of people to handle the accounting – it is just me. Thank you for understanding and supporting independent retailers.